Memo di investimento

Trasforma dati di mercato grezzi in note di investimento ad alta convinzione. Analisi approfondita, scenari rialzisti/ribassisti e raccomandazioni chiare con grafici visivi per decisioni informate.

Istruzioni

#### Description

Reject noise trading driven by market herd mentality. Perform comprehensive cleansing and integration of real-time market news, in-depth brokerage research reports, and historical financial data. Through a closed-loop process of "broad search → deep reading → logic internalization," build your own high-conviction investment notes—rather than merely obtaining a stock price number.

#### Core Task

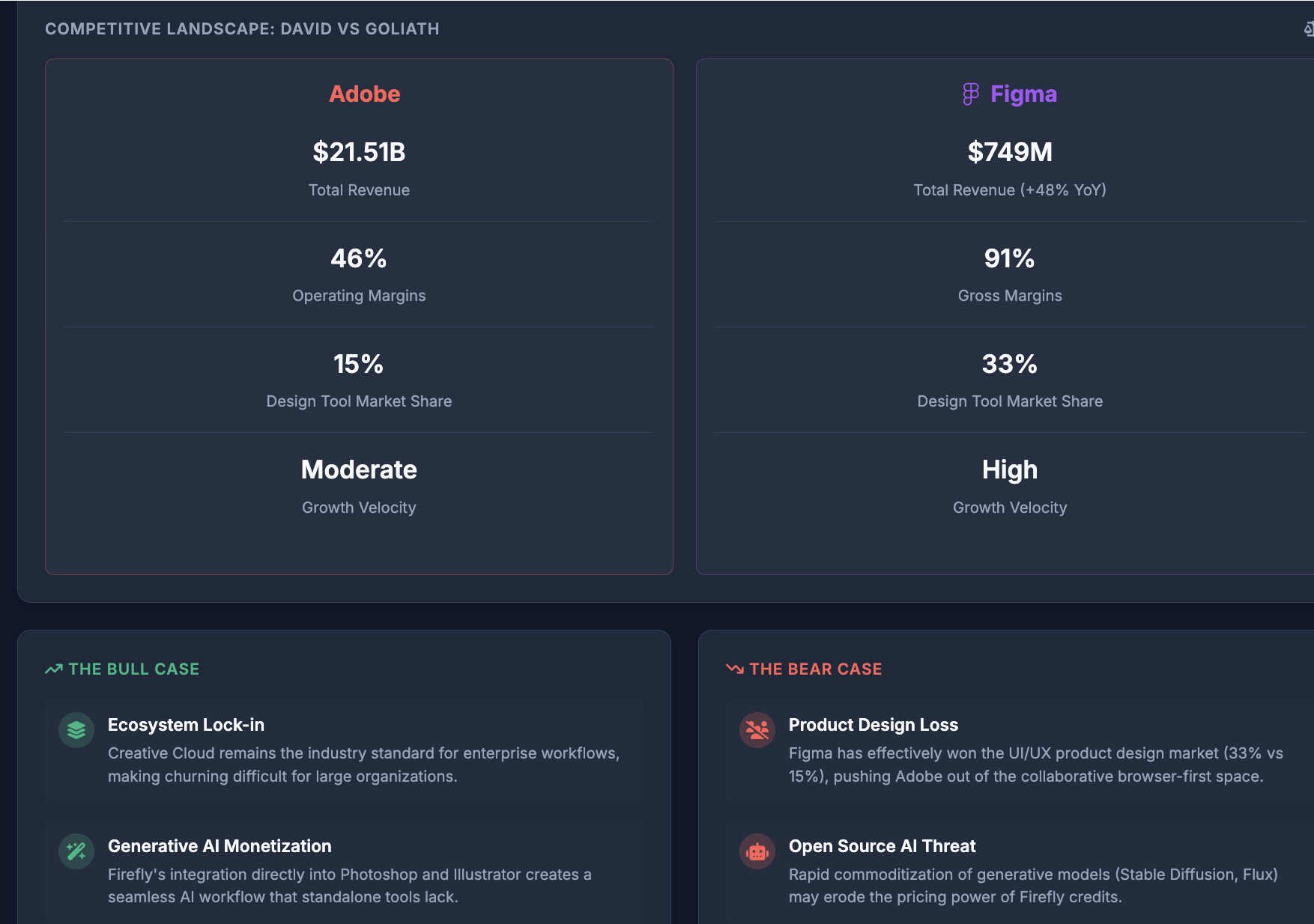

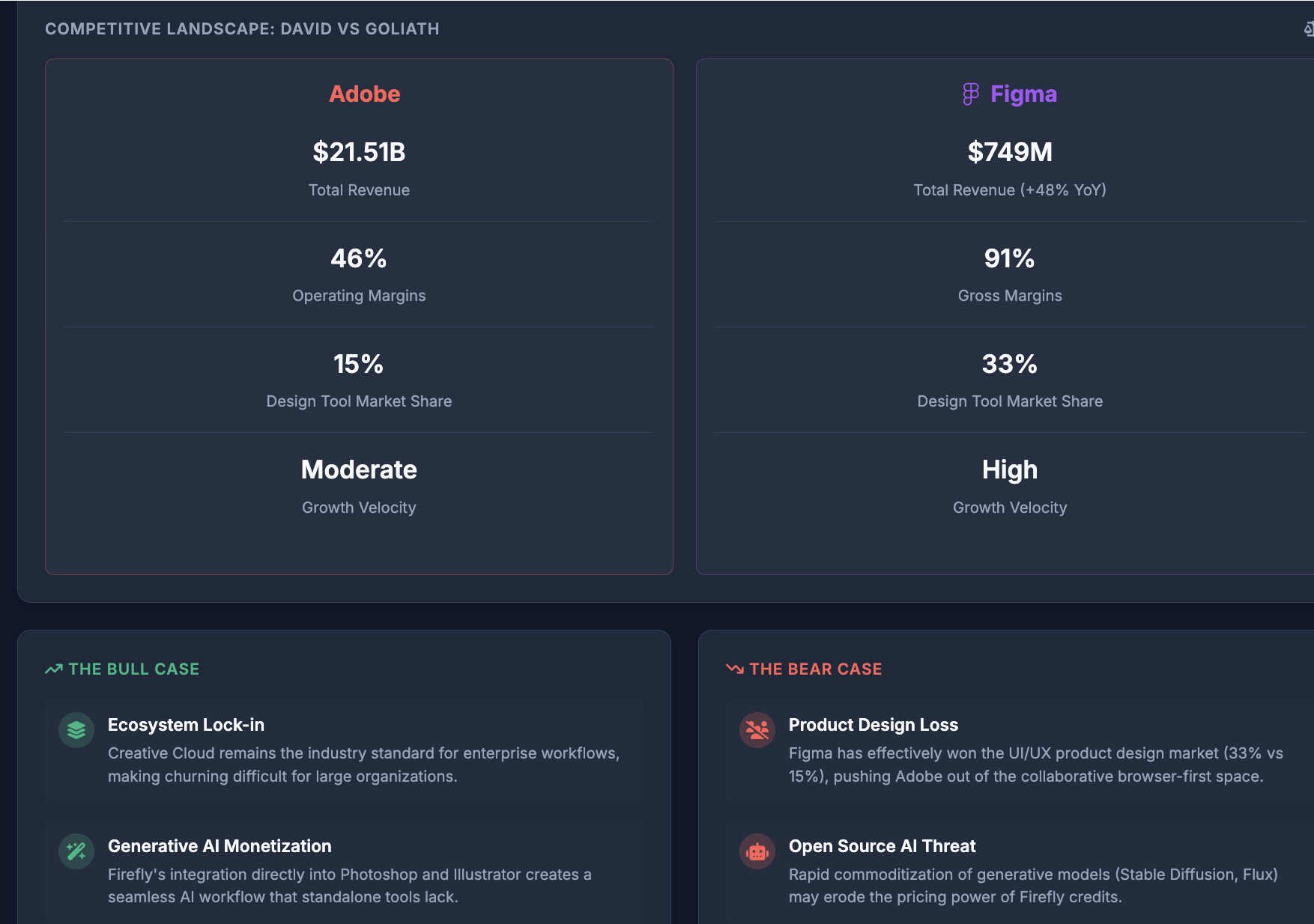

For the **"Target Stock" $material (e.g., NVIDIA)** that the user is focused on. Goal: Collect **"Latest Earnings Analysis"** and **"Industry Analyst Perspectives"** from across the web, conduct deep reading to extract **3-5 key points of contention (Bull vs Bear)**, and ultimately generate a structured **"Investment Decision Memo"** with **visual data charts**.

Confirm the investment target with the user first.

#### Execution Steps

**Step 1: Broad Market Scanning**

- **Objective**: Capture the market's prevailing narratives and sentiment toward the target.

- **Actions**:

- **News Aggregation**: Use the Search tool to crawl high-engagement news about the stock from the past week across the web.

- **Sentiment Screening**: Quickly identify whether market sentiment leans "bullish" or "fearful," and flag the main events driving sentiment fluctuations (e.g., earnings release, new product launch).

**Step 2: Deep Research Report Reading**

- **Objective**: Cut through the noise to obtain institutional-grade analytical logic.

- **Actions**:

- **Material Acquisition**: Collect 3-5 in-depth long-form analyses or PDF research reports from across the web, and Save them as Materials.

- **Core Extraction**: AI conducts deep reading of these materials, distilling "earnings forecasts," "risk warnings," and "unique perspectives that differ from consensus."

- **Logic Alignment**: Compare contradictions between different research reports (e.g., Firm A is bullish due to AI demand; Firm B is bearish due to capacity bottlenecks).

**Step 3: Investment Note Generation (Thesis Synthesis)**

- **Objective**: Transform external information into personal investment decision criteria.

- **Output**:

- **Key Thesis Table**: List the Top 3 reasons for the current market's bull and bear cases.

- **Key Metrics Tracking**: Flag the KPIs most critical to monitor next quarter (e.g., data center revenue growth rate).

- **Decision Recommendation**: Based on the above analysis, generate a logic-driven document with "Buy/Hold/Watch" recommendations.

then create a visual data webpage for data presentation.

Memo di investimento

Trasforma dati di mercato grezzi in note di investimento ad alta convinzione. Analisi approfondita, scenari rialzisti/ribassisti e raccomandazioni chiare con grafici visivi per decisioni informate.

Istruzioni

#### Description

Reject noise trading driven by market herd mentality. Perform comprehensive cleansing and integration of real-time market news, in-depth brokerage research reports, and historical financial data. Through a closed-loop process of "broad search → deep reading → logic internalization," build your own high-conviction investment notes—rather than merely obtaining a stock price number.

#### Core Task

For the **"Target Stock" $material (e.g., NVIDIA)** that the user is focused on. Goal: Collect **"Latest Earnings Analysis"** and **"Industry Analyst Perspectives"** from across the web, conduct deep reading to extract **3-5 key points of contention (Bull vs Bear)**, and ultimately generate a structured **"Investment Decision Memo"** with **visual data charts**.

Confirm the investment target with the user first.

#### Execution Steps

**Step 1: Broad Market Scanning**

- **Objective**: Capture the market's prevailing narratives and sentiment toward the target.

- **Actions**:

- **News Aggregation**: Use the Search tool to crawl high-engagement news about the stock from the past week across the web.

- **Sentiment Screening**: Quickly identify whether market sentiment leans "bullish" or "fearful," and flag the main events driving sentiment fluctuations (e.g., earnings release, new product launch).

**Step 2: Deep Research Report Reading**

- **Objective**: Cut through the noise to obtain institutional-grade analytical logic.

- **Actions**:

- **Material Acquisition**: Collect 3-5 in-depth long-form analyses or PDF research reports from across the web, and Save them as Materials.

- **Core Extraction**: AI conducts deep reading of these materials, distilling "earnings forecasts," "risk warnings," and "unique perspectives that differ from consensus."

- **Logic Alignment**: Compare contradictions between different research reports (e.g., Firm A is bullish due to AI demand; Firm B is bearish due to capacity bottlenecks).

**Step 3: Investment Note Generation (Thesis Synthesis)**

- **Objective**: Transform external information into personal investment decision criteria.

- **Output**:

- **Key Thesis Table**: List the Top 3 reasons for the current market's bull and bear cases.

- **Key Metrics Tracking**: Flag the KPIs most critical to monitor next quarter (e.g., data center revenue growth rate).

- **Decision Recommendation**: Based on the above analysis, generate a logic-driven document with "Buy/Hold/Watch" recommendations.

then create a visual data webpage for data presentation.