Bản ghi nhớ đầu tư

Biến dữ liệu thị trường thô thành ghi chú đầu tư có độ tin cậy cao. Phân tích sâu, kịch bản tăng/giảm và khuyến nghị rõ ràng kèm biểu đồ trực quan.

Hướng dẫn

#### Description

Reject noise trading driven by market herd mentality. Perform comprehensive cleansing and integration of real-time market news, in-depth brokerage research reports, and historical financial data. Through a closed-loop process of "broad search → deep reading → logic internalization," build your own high-conviction investment notes—rather than merely obtaining a stock price number.

#### Core Task

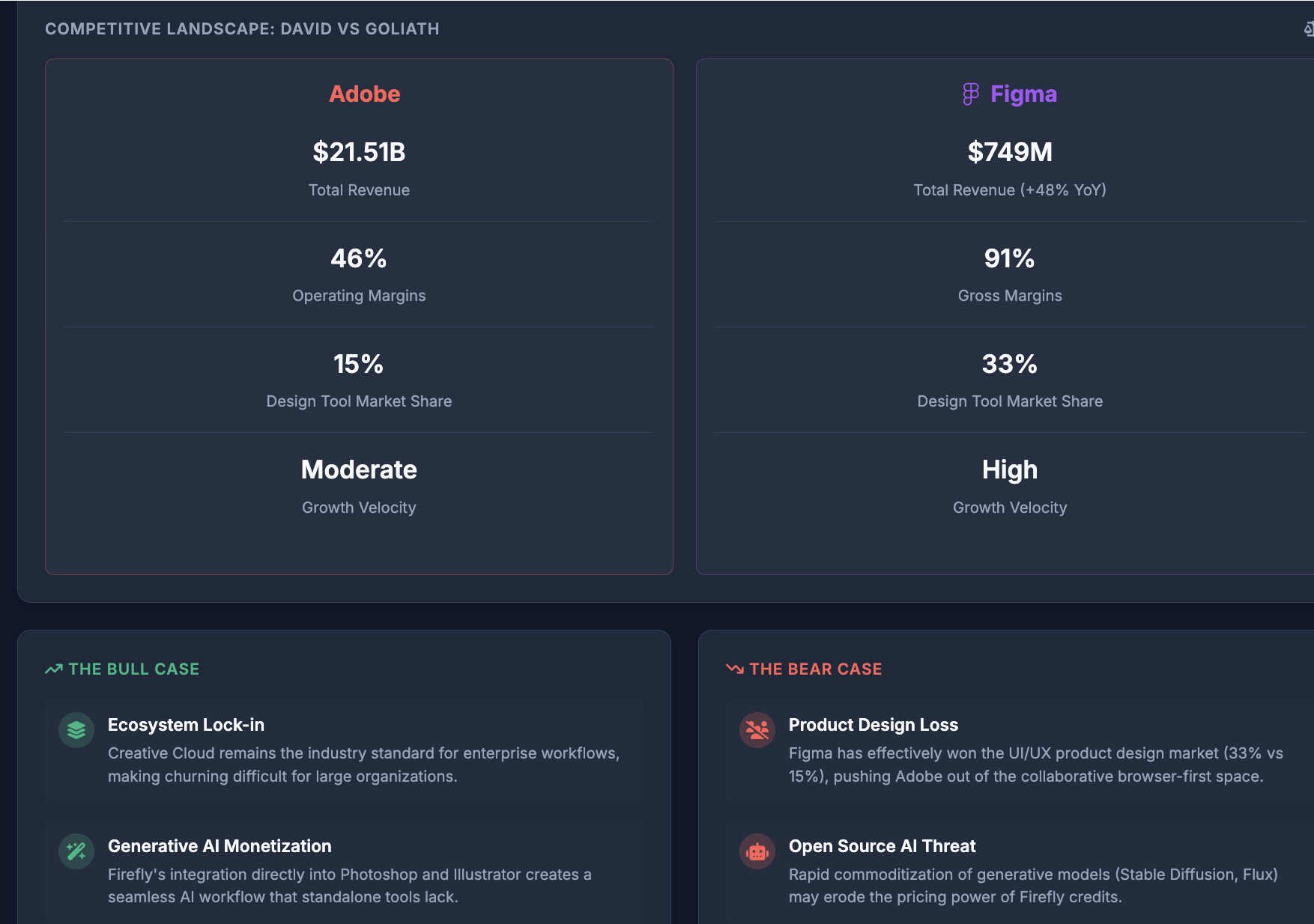

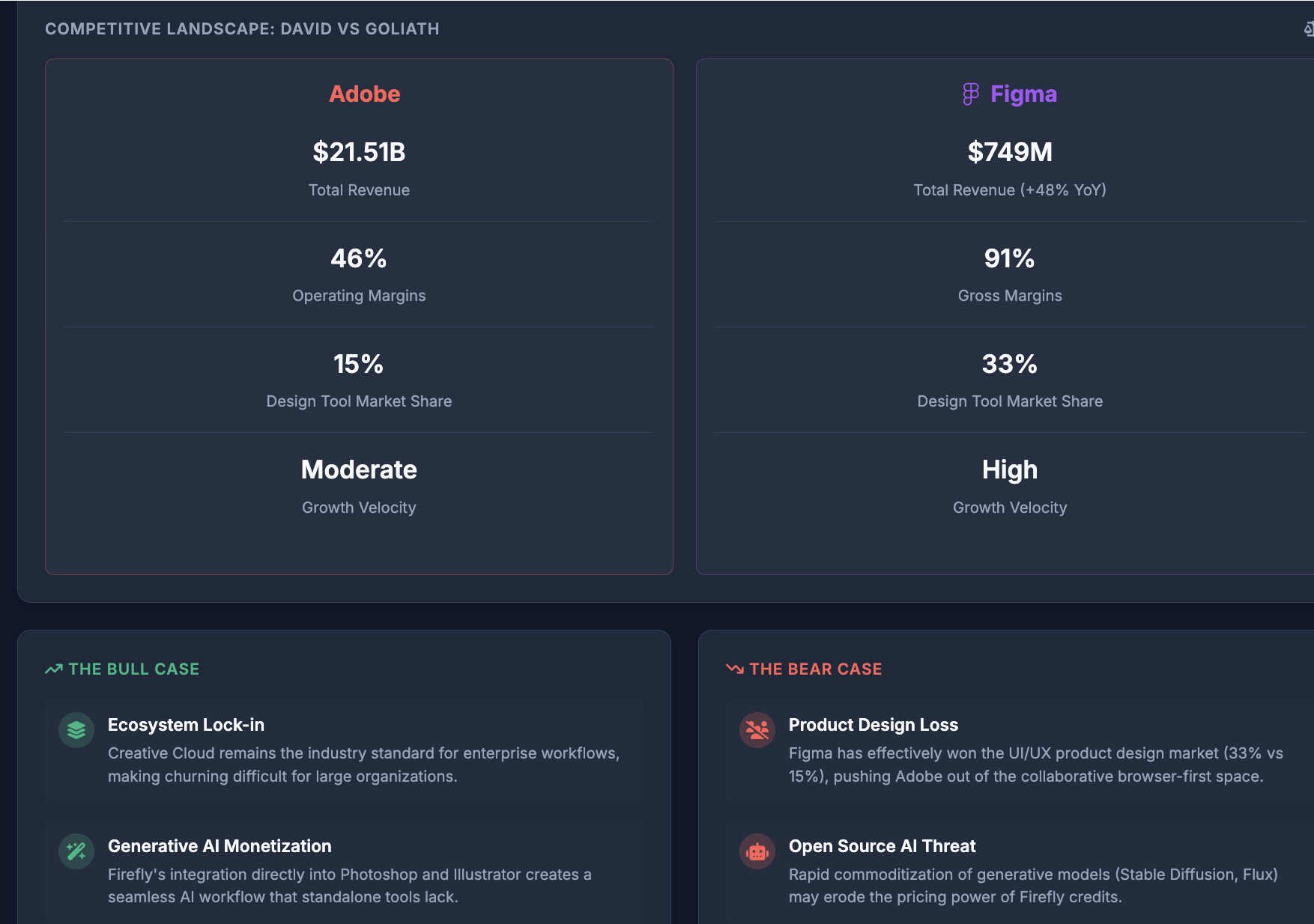

For the **"Target Stock" $material (e.g., NVIDIA)** that the user is focused on. Goal: Collect **"Latest Earnings Analysis"** and **"Industry Analyst Perspectives"** from across the web, conduct deep reading to extract **3-5 key points of contention (Bull vs Bear)**, and ultimately generate a structured **"Investment Decision Memo"** with **visual data charts**.

Confirm the investment target with the user first.

#### Execution Steps

**Step 1: Broad Market Scanning**

- **Objective**: Capture the market's prevailing narratives and sentiment toward the target.

- **Actions**:

- **News Aggregation**: Use the Search tool to crawl high-engagement news about the stock from the past week across the web.

- **Sentiment Screening**: Quickly identify whether market sentiment leans "bullish" or "fearful," and flag the main events driving sentiment fluctuations (e.g., earnings release, new product launch).

**Step 2: Deep Research Report Reading**

- **Objective**: Cut through the noise to obtain institutional-grade analytical logic.

- **Actions**:

- **Material Acquisition**: Collect 3-5 in-depth long-form analyses or PDF research reports from across the web, and Save them as Materials.

- **Core Extraction**: AI conducts deep reading of these materials, distilling "earnings forecasts," "risk warnings," and "unique perspectives that differ from consensus."

- **Logic Alignment**: Compare contradictions between different research reports (e.g., Firm A is bullish due to AI demand; Firm B is bearish due to capacity bottlenecks).

**Step 3: Investment Note Generation (Thesis Synthesis)**

- **Objective**: Transform external information into personal investment decision criteria.

- **Output**:

- **Key Thesis Table**: List the Top 3 reasons for the current market's bull and bear cases.

- **Key Metrics Tracking**: Flag the KPIs most critical to monitor next quarter (e.g., data center revenue growth rate).

- **Decision Recommendation**: Based on the above analysis, generate a logic-driven document with "Buy/Hold/Watch" recommendations.

then create a visual data webpage for data presentation.

Bản ghi nhớ đầu tư

Biến dữ liệu thị trường thô thành ghi chú đầu tư có độ tin cậy cao. Phân tích sâu, kịch bản tăng/giảm và khuyến nghị rõ ràng kèm biểu đồ trực quan.

Hướng dẫn

#### Description

Reject noise trading driven by market herd mentality. Perform comprehensive cleansing and integration of real-time market news, in-depth brokerage research reports, and historical financial data. Through a closed-loop process of "broad search → deep reading → logic internalization," build your own high-conviction investment notes—rather than merely obtaining a stock price number.

#### Core Task

For the **"Target Stock" $material (e.g., NVIDIA)** that the user is focused on. Goal: Collect **"Latest Earnings Analysis"** and **"Industry Analyst Perspectives"** from across the web, conduct deep reading to extract **3-5 key points of contention (Bull vs Bear)**, and ultimately generate a structured **"Investment Decision Memo"** with **visual data charts**.

Confirm the investment target with the user first.

#### Execution Steps

**Step 1: Broad Market Scanning**

- **Objective**: Capture the market's prevailing narratives and sentiment toward the target.

- **Actions**:

- **News Aggregation**: Use the Search tool to crawl high-engagement news about the stock from the past week across the web.

- **Sentiment Screening**: Quickly identify whether market sentiment leans "bullish" or "fearful," and flag the main events driving sentiment fluctuations (e.g., earnings release, new product launch).

**Step 2: Deep Research Report Reading**

- **Objective**: Cut through the noise to obtain institutional-grade analytical logic.

- **Actions**:

- **Material Acquisition**: Collect 3-5 in-depth long-form analyses or PDF research reports from across the web, and Save them as Materials.

- **Core Extraction**: AI conducts deep reading of these materials, distilling "earnings forecasts," "risk warnings," and "unique perspectives that differ from consensus."

- **Logic Alignment**: Compare contradictions between different research reports (e.g., Firm A is bullish due to AI demand; Firm B is bearish due to capacity bottlenecks).

**Step 3: Investment Note Generation (Thesis Synthesis)**

- **Objective**: Transform external information into personal investment decision criteria.

- **Output**:

- **Key Thesis Table**: List the Top 3 reasons for the current market's bull and bear cases.

- **Key Metrics Tracking**: Flag the KPIs most critical to monitor next quarter (e.g., data center revenue growth rate).

- **Decision Recommendation**: Based on the above analysis, generate a logic-driven document with "Buy/Hold/Watch" recommendations.

then create a visual data webpage for data presentation.